Latest regulations have compelled financial institutions to better transparency on trade reconstru

ction: regulators from both sides of the Atlantic (eg. Dodd Franck Act – DFA in the US and Mifid2 in EU) can ask for complete data record on every executed transactions. The idea is to be able to clearly identify responsibilities and execute sanctions measures if any irregularity was identified on a deal. More precisely, for any trade made during the past 7 years, volumes of data to be stored is significant, as audit trail of all related operations (settlements, clearing …) are required.

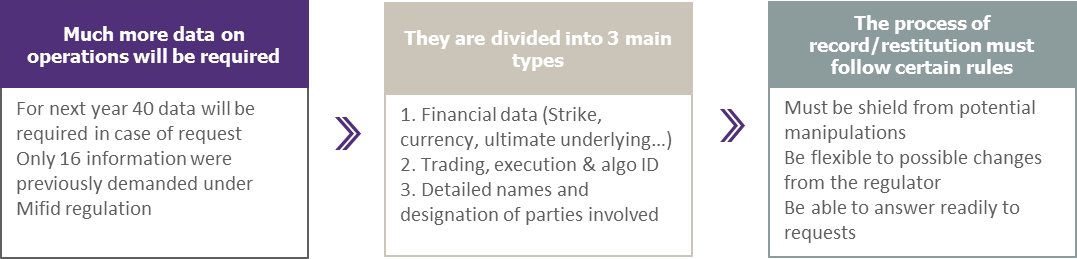

Mifid 2 (to be enacted 1/01/2018) clearly illustrates this tendency, as the amount of data to provide will expand.

This situation is challenging organizations as they will be required to model a new record management process that is expected to offer:

- Short delays to provide elements when requested (less than 3 days is allowed to restitute a complete trade operation and history on swaps according to Dodd-Franck Act)

- Flexibility to integrate possible amendments from the regulator (Indeed for instance Mifid2 requires that enacted amendments must be included in the process readily)

- Security systems to avoid data manipulation

These three criteria are paramount but implementation complex as some structured products originated by banks can be really challenging for trade reconstruction. Indeed let’s consider a deal involving several asset classes such as a hybrid product where different Front-to-back and systems lines are mobilized:

Concerning this kind of product which is often negotiated OTC (which is the primary target of Mifid2 and DFA), the trade reconstruction becomes a real challenge for banks: How can we set up an efficient and streamlined reconstruction process ? What IT structure can be built and how will the Data governance be implemented ?

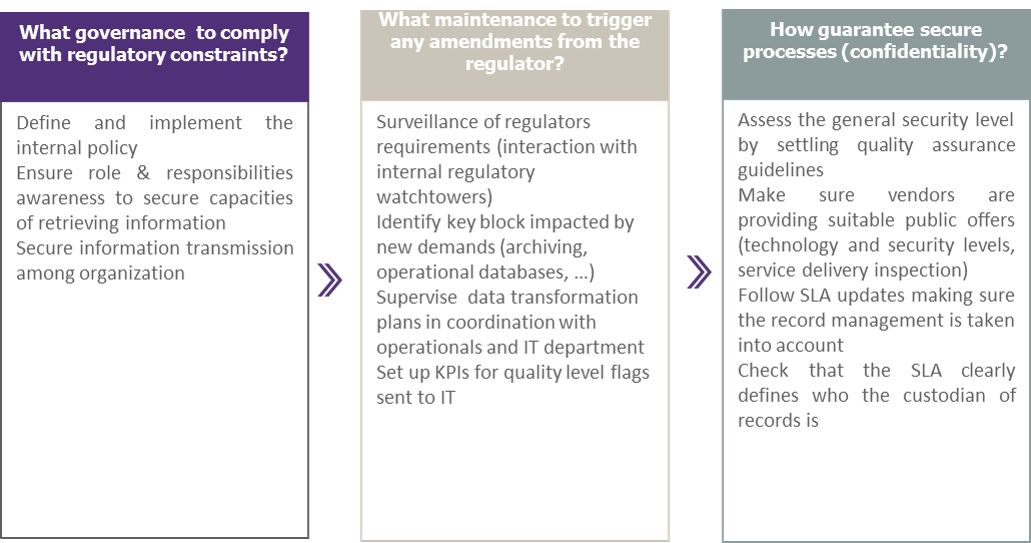

A chief data officer should be the central actor in record management function, his responsibilities being divided into three roles:

- Make sure a governance is settled on data storage

- Ensure that required datasets from regulators are monitored to maintain any changes

- Inspect that relevant data are secured (on both internal and external sides – potential outsourcing policy on data conservation to secure)

Hence, the CDO function is at the crossroads of all compliance, operational and IT functions:

The biggest challenges will be:

- To implement this transversal and global function for activities which have traditional not been harmonized

- To make sure this new function is well integrated within the existing organization

More generally, this new model ought to have a broader view: financial institutions must avoid the mindset “one regulation = one process to answer” which has been prevailing so far. This attitude tends to generate an accumulation of processes which are sometimes contradictory and inefficient.

To reverse this situation, the Record management can be included into a restructured agile organization able to fill at the same time many diverse demands. Banks able to take that path are likely to develop a real competitive advantage in a stricter regulated environment.